PUNJAB,

Qualification:CA/ICWAI/B.Com/M.Com₹As Per Notification

PUNJAB,

Qualification:CA/ICWAI/B.Com/M.Com₹As Per Notification

1. Official Website: Visit the official website of PSPCL for the latest and most accurate information regarding the Revenue Accountant, Internal Auditor & Other Recruitment. This includes details about the syllabus, exam pattern, and any recommended study materials.

2. Previous Year Papers: Obtain and go through previous years' question papers to understand the exam pattern, types of questions asked, and the difficulty level. This can be valuable for your preparation.

3. Syllabus and Exam Pattern: Understand the prescribed syllabus and exam pattern for the specific positions you are applying for. This information is usually available in the official recruitment notification or on the official website.

4. Accounting and Auditing Books: For positions like Revenue Accountant and Internal Auditor, focus on accounting principles, financial management, and auditing. Some recommended books include "Accounting Principles" by Weygandt, Kimmel, and Kieso, and "Auditing and Assurance Services" by Alvin A. Arens.

5. Financial Management Books: Understand the basics of financial management, budgeting, and financial analysis. Books like "Financial Management: Principles and Applications" by Sheridan Titman and Arthur J. Keown can be useful.

6. Quantitative Aptitude and Reasoning Books: Many competitive exams include sections on quantitative aptitude and reasoning. Use books that cover topics like numerical ability, data interpretation, and logical reasoning.

7. Online Resources: Explore online learning platforms, educational websites, and forums that offer study materials, practice tests, and discussions related to accounting, auditing, and quantitative aptitude. Websites like Khan Academy, Investopedia, and others may have relevant resources.

8. Financial News and Journals: Stay updated on financial news and read articles from reputable financial journals. This can help you stay informed about current affairs and developments in the financial sector.

.svg.webp)

WEST BENGAL,

Qualification:Any Degree₹240000/- CTC

.svg.webp)

WEST BENGAL,

Qualification:MBBS / B.Sc Nursing / Post Graduation in Psychology/Social Work / Graduate with Diploma in Computer Application₹252000/- CTC

ANDHRA PRADESH, ASSAM, ARUNACHAL PRADESH, BIHAR, GUJRAT, HARYANA, HIMACHAL PRADESH, JAMMU & KASHMIR, KARNATAKA, KERALA, MADHYA PRADESH, MAHARASHTRA, MANIPUR, MEGHALAYA, MIZORAM, NAGALAND, ORISSA, PUNJAB, RAJASTHAN, SIKKIM, TAMIL NADU, TRIPURA, UTTAR PRADESH, WEST BENGAL, DELHI, GOA, PONDICHERY, LAKSHDWEEP, DAMAN & DIU, DADRA & NAGAR, CHANDIGARH, ANDAMAN & NICOBAR, UTTARANCHAL, JHARKHAND, CHATTISGARH, TELANGANA, UTTARAKHAND,

Qualification:B.Tech/ B.E₹945600/- CTC

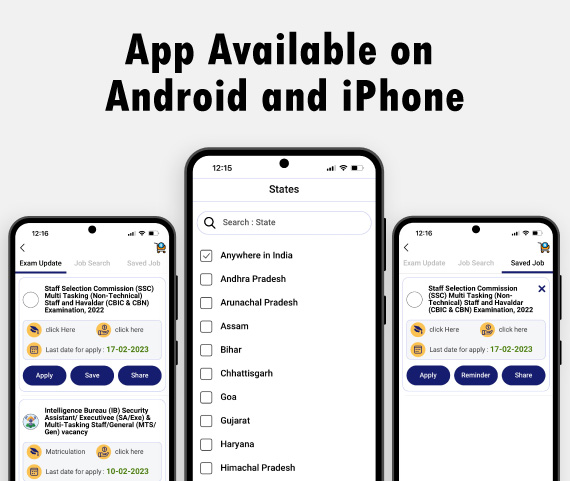

In addition to job listings, the app also provides valuable resources for job seekers, including information on the application process, interview tips, and more. Whether you're a recent graduate or an experienced professional, the Government Job List App has everything you need to take your career to the next level. Download now and start your journey to a rewarding government career!"