ASSAM,

Qualification:Diploma/Degree (Relevant Subject)₹1104000/- CTC

ASSAM,

Qualification:Diploma/Degree (Relevant Subject)₹1104000/- CTC

1. Accounting and Finance Books:

"Financial Accounting" by Robert Libby, Patricia Libby, and Frank Hodge

"Cost Accounting: A Managerial Emphasis" by Charles T. Horngren, Srikant M. Datar, and Madhav V. Rajan

"Management Accounting" by Anthony A. Atkinson, Robert S. Kaplan, Ella Mae Matsumura, and S. Mark Young

"Fundamentals of Financial Management" by Eugene F. Brigham and Joel F. Houston

"Auditing and Assurance Services" by Alvin A. Arens, Randal J. Elder, and Mark S. Beasley

2. Taxation Books:

"Income Tax Fundamentals" by Gerald E. Whittenburg, Martha Altus-Buller, and Steven Gill

"Goods and Services Tax: Law and Practice" by V.S. Datey

"Guide to Tax Audit" by Vikas Mundada

3. General Awareness Books:

"Manorama Yearbook" for current affairs and general knowledge

"Lucent's General Knowledge" by Dr. Binay Karna, Manwendra Mukul, Sanjeev Kumar, Renu Sinha, and R. P. Suman

4. English Language Books:

"Objective General English" by S.P. Bakshi

"Word Power Made Easy" by Norman Lewis

"High School English Grammar and Composition" by Wren and Martin

5. Quantitative Aptitude Books:

"Quantitative Aptitude for Competitive Examinations" by R.S. Aggarwal

"Fast Track Objective Arithmetic" by Rajesh Verma

6. Logical Reasoning Books:

"A Modern Approach to Verbal & Non-Verbal Reasoning" by R.S. Aggarwal

"Analytical Reasoning" by M.K. Pandey

7. Online Resources:

Websites like Gradeup, Testbook, and Oliveboard offer study materials, mock tests, and practice questions specifically tailored for competitive exams.

Educational platforms such as Coursera, Udemy, and Khan Academy offer courses on accounting, finance, taxation, and related subjects.

GUJRAT,

Qualification:Ph.D. (completed or thesis submitted) in Engineering/Science related fields₹₹72,000 – ₹84,000 per month (Consolidated)

DELHI,

Qualification:MBBS + MPH / BDS + MPH / MD (Community Medicine)₹₹1,20,000/- (Consolidated)

GOA,

Qualification:B.Tech/B.E, Diploma, 12TH₹

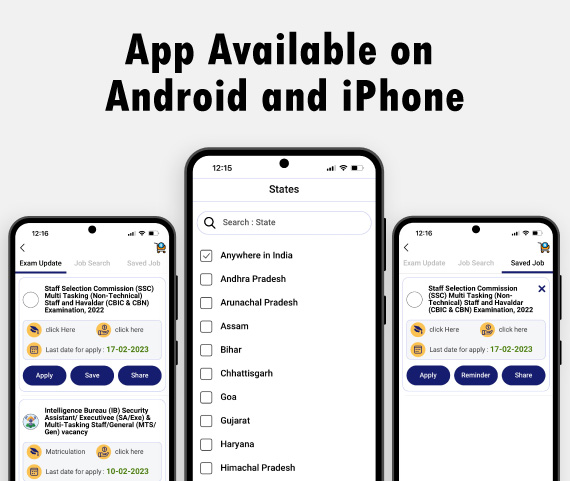

In addition to job listings, the app also provides valuable resources for job seekers, including information on the application process, interview tips, and more. Whether you're a recent graduate or an experienced professional, the Government Job List App has everything you need to take your career to the next level. Download now and start your journey to a rewarding government career!"